Blue-chip stocks in Malaysia: what they are and how to invest in them

Key characteristics of blue-chip stocks

How to identify Malaysia's blue-chip stocks

Differences between blue-chip and penny stocks

Advantages and disadvantages of blue-chip stocks

How to invest in blue-chip stocks

Top 3 blue-chip stocks in Malaysia

If you're interested in investing, you might have heard about 'blue-chip stocks'. The name comes from poker, where blue chips represent the highest value. In finance, blue-chip stocks are considered the best to invest in. In the article, we'll dive deeper into the blue-chip stocks in Malaysia and discuss their pros and cons so that you can make better choices when investing.

Blue-chip stocks are the shares of huge well-known companies that have been successful for a long time. These companies are considered to be the top players in their field—everyone trusts them because they usually do well. The term 'blue chip' is derived from poker. In this game, blue chips are regarded as the most valuable ones.What are blue-chip stocks?

Blue-chip index

There's a term 'blue-chip index'. This is like a scoreboard that tracks how these big companies' stocks perform. It shows if their stock prices are going up or down. In this scoreboard, companies with higher stock prices have a more significant impact on the score than those with lower prices.

Investing in blue-chip stocks is safer than investing in smaller or less-known enterprises because these big companies are more stable. Since Malaysia's blue-chip companies are strong financially and have a good reputation, they usually come with less risk. They also often pay regular dividends, which is extra money to investors, and those payments tend to increase over time. That is why many people see blue-chip stocks as a safe investment method.

Here are the major features of blue-chip stocks: Characteristic Description Not all blue-chip companies in Malaysia are guaranteed to be good investments. It's worth noting that blue-chip companies usually grow slower than smaller enterprises that can adapt and have strong leaders. However, some investors still feel that blue-chip companies are safer to invest in.Key characteristics of blue-chip stocks

Stability

Blue-chip companies can handle tough times. Even when the economy is doing poorly, or things drastically change in the market, these companies usually stay strong and keep going. They have a history of bouncing back, which makes them a safer choice for investors.

Payment of dividends

When you own these stocks, they often pay a share of a company’s profit, which is called dividends. Plus, the value of these stocks can go up over time, so you can profit in two ways: from the cash payments and by selling the stock for more than what you paid.

Financial stability

These businesses have a good amount of money coming in, not much debt, and manage their money well. This means they're less likely to go broke and can keep paying their investors.

Established reputation

Blue-chip companies are well-known businesses that make good products or provide reliable services. People trust them, and both customers and investors feel confident about them.

Market capitalisation

When we say they have high market capitalisation, it means these companies are worth a lot of money in the stock market. Basically, they are some of the biggest and most valuable businesses out there.

Liquidity

They are traded on big stock markets, like online stores where people buy and sell shares. Because they're on these big markets, it's easy for investors to buy or sell them whenever they want.

Longevity

Blue-chip businesses are like well-established brands that have been around for a long time, often for many years or even decades. They've shown that they can adapt to changes and keep doing well, which makes them reliable choices for investors.

A blue-chip company is a big, well-established business that is usually really reliable. Here's how you can tell if a company is a blue-chip:How to identify Malaysia's blue-chip stocks

.png)

When people talk about investing in the stock market, they often mention blue-chip and penny stocks. These are two types of stocks, each with their own good and bad points. Let's understand the two stocks in more detail. Characteristic Blue-chip stocks Penny stocksDifferences between blue-chip and penny stocks

Capital requirements

Blue-chip stocks cost a lot of money, and you need a good amount of cash to invest in them.

Penny stocks are relatively cheap. Sometimes you can buy them for just a few cents. It’s like trying out a new brand you've never heard of.

Risk

These companies have been around for a long time and usually make steady profits, so they're safer to invest in.

Because they're often from newer or smaller companies, they can be very risky—meaning you might lose your money if the company doesn't do well.

Timeframes

Long-term investors usually prefer blue-chip stocks because they're safer and more stable over time.

Short-term investors who want to make quick profits might go for penny stocks even though they come with more risk.

Here are the positives of investing in blue-chip stocks: Here are the potential risks and drawbacks of blue-chip stocks:Advantages and disadvantages of blue-chip stocks

If you want to invest in blue-chip stocks, here's what you can do:How to invest in blue-chip stocks

Company Sector Description Forward dividend yieldTop 3 blue-chip stocks in Malaysia

Top Glove Corporation Berhad

Healthcare

Top Glove is a company that produces and sells different types of gloves. They manufacture many kinds of gloves, made of materials such as latex, nitrile, polychloroprene, and flexylon. Their gloves are used in many different areas, like aerospace (for aeroplane maintenance), food (to keep things clean when preparing food), beauty (for salons and spas), medical (hospitals and clinics), home care (for cleaning and other tasks at home). Most of Top Glove's sales come from nitrile and powdered latex gloves, with many customers from North America and Europe.

Around 10%

Malayan Banking Berhad

Financial Services

Maybank is a large bank in Malaysia and Southeast Asia. It offers various financial services, which can be grouped into three main areas: community financial services, global banking, and services for businesses, investments, and insurance. Most of Maybank's profits come from helping regular customers and small to medium-sized businesses with their banking needs.

Around 6%

Petronas Gas Berhad

Industrial Services

Petronas Gas is a critical company in Malaysia that deals with gas and utilities (services like water and electricity). The national oil company, Petronas, owns most of it. The main areas they work in are gas processing and gas transportation. They move natural gas through pipelines to customers in Malaysia and Singapore. They also provide essential services and turn liquid gas back into gas for use. The business's gas processing and transportation parts make up most of its profits.

Around 4,5%

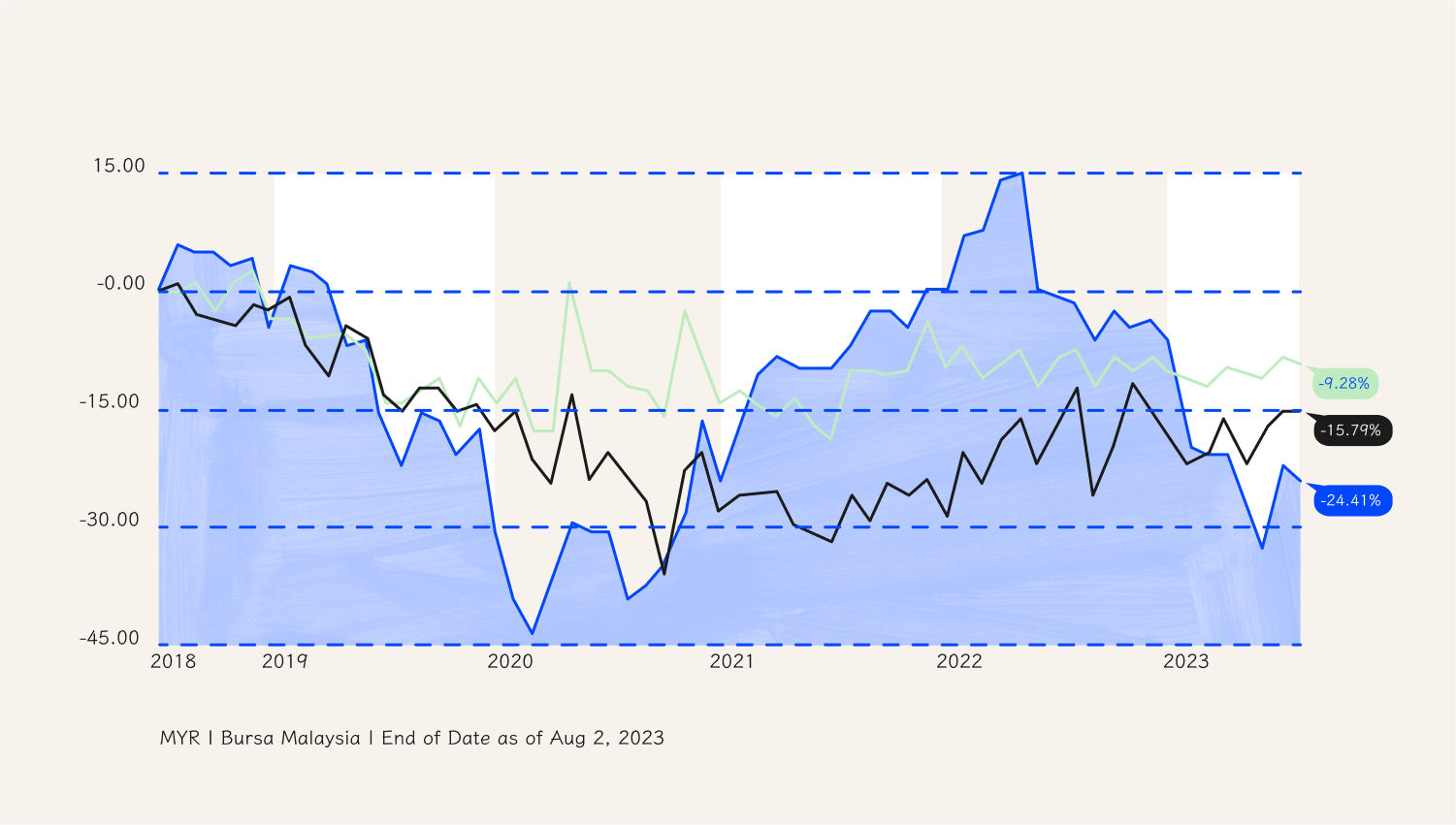

Petronas stocks

Final thoughts