Back

18 Feb 2020

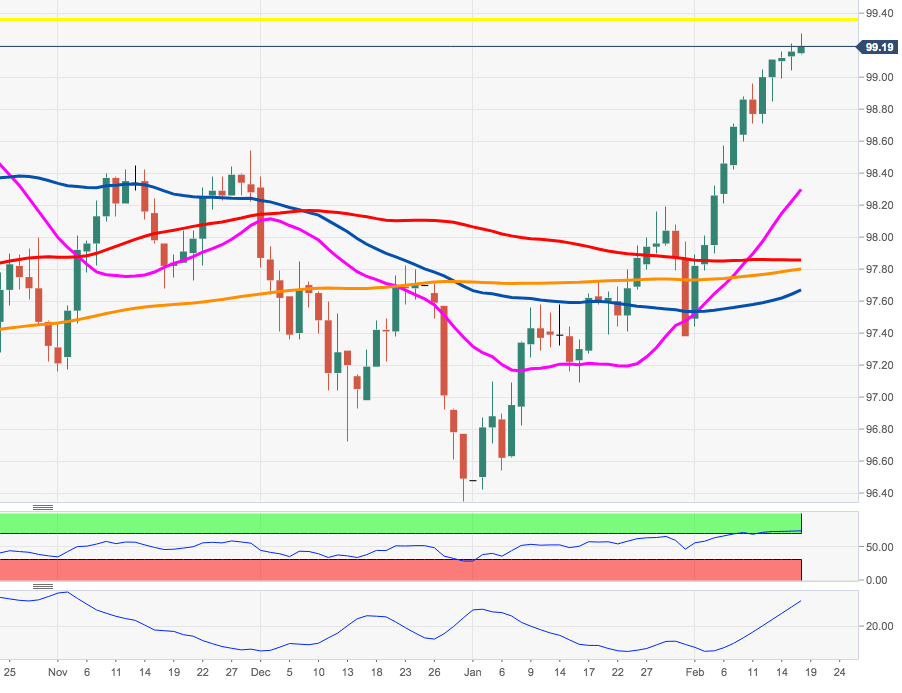

US Dollar Index Price Analysis: Rally looks overbought near 99.30

- The upside momentum in DXY seems unabated near 99.30.

- The next target on the upside remains at 99.37 (September 3rd, 2019).

DXY keeps pushing higher in the first half of the week and is already trading at shouting distance from the next target at 99.37.

The current overbought levels in the dollar, however, could spark a corrective downside in the index to, initially, the Fibo retracement of the February rally at 98.82. This support zone is also reinforced by the proximity of the 10-day SMA at 98.86.

Looking at the broader picture, the constructive perspective on the dollar is seen unaltered as long as the 200-day SMA at 97.78 holds the downside.

DXY daily chart